Property Recruitment Insights - March 2025

Understanding the latest hiring trends in the UK property sector

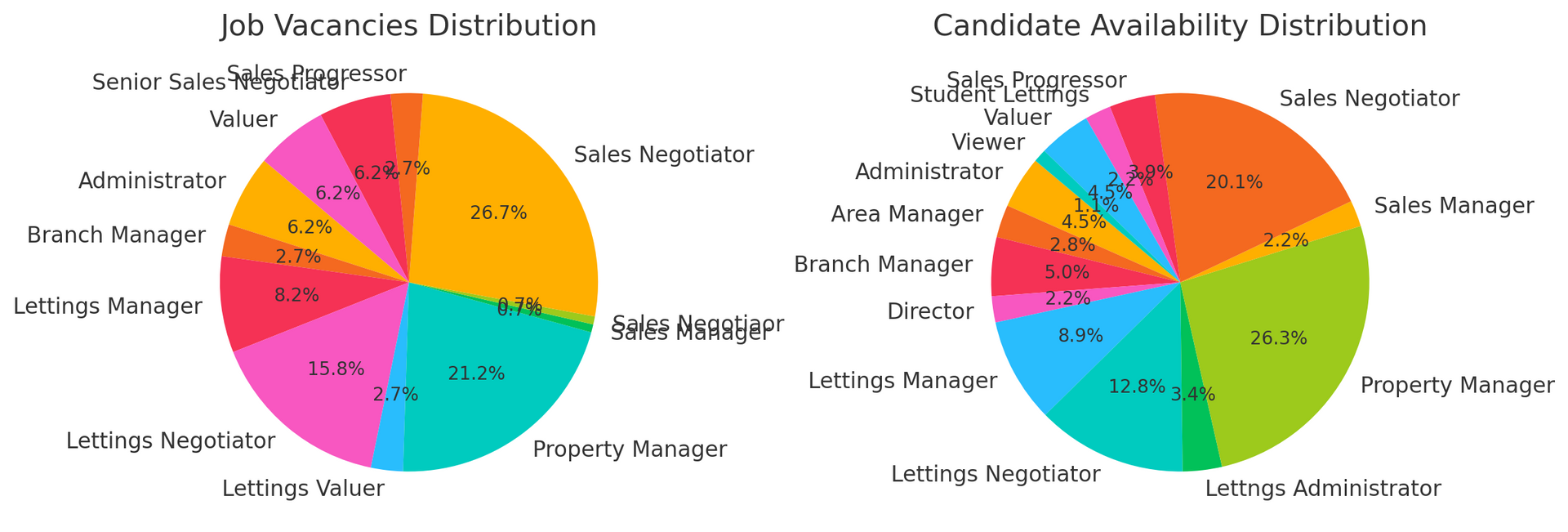

Over the past three months, the property industry has experienced notable shifts in recruitment dynamics. By analysing job listings and candidate activity from December 2024 to February 2025, we can discern patterns that shed light on the current state of the market.

Job Vacancies vs. Active Candidates

Overview

This report provides an analysis of the current property recruitment market by comparing candidate availability with job vacancies across key roles. The data highlights areas of surplus and shortage, offering insights for employers looking to attract and retain talent.

Key Findings

- Administrator Roles

- Over recent months, the number of available candidates for administrator roles has fluctuated slightly, while vacancies have remained fairly stable. This suggests a consistent demand for administrative support, with employers needing to act promptly to secure top talent.

- Property Manager Roles

- The demand for property managers has seen steady growth, but candidate availability has not always kept pace. There has been a slight increase in vacancies, indicating ongoing hiring activity in this sector. Employers may need to offer competitive salaries or benefits to attract the right candidates, while job seekers should highlight their property management experience to stand out.

- Area Manager Roles

- The availability of area managers has increased, while vacancies have seen a decline. This indicates a growing surplus of candidates, making it a competitive market for job seekers in this role.

- Branch Manager Roles

- Candidate availability has remained relatively steady, while vacancies have decreased slightly month-on-month. This suggests that businesses are being more selective in hiring for leadership positions, making it crucial for candidates to differentiate themselves.

- Director Roles

- The market for director roles has shown little movement, with few new vacancies emerging. The limited recruitment activity at this level indicates that businesses are focusing on internal promotions or maintaining stability rather than bringing in new senior leadership.

- Lettings Manager Roles

- The demand for lettings managers has remained high, but there has been a noticeable increase in candidate availability. This suggests a competitive hiring landscape, where businesses can afford to be selective, and job seekers must demonstrate strong expertise to stand out.

- Sales Negotiator Roles

- The market for sales negotiators has shown a gradual increase in vacancies, with a steady flow of available candidates. However, recent trends indicate that competition for these roles is intensifying, with businesses seeking individuals who can bring strong sales and customer service skills to the table.

- Lettings Negotiator Roles

- The demand for lettings negotiators has remained strong, with vacancies showing consistent growth. However, candidate availability has also risen, leading to a more competitive hiring environment. Employers may need to refine their selection criteria, while job seekers should focus on showcasing their negotiation skills and industry knowledge to secure positions.

Conclusion

The property recruitment market continues to evolve, with some roles experiencing an increase in available talent while others see a decline in vacancies. Employers should remain strategic in their hiring decisions, balancing immediate needs with long-term growth. Candidates, especially in roles with high competition, should focus on enhancing their skills and experience to remain attractive to potential employers.

For businesses looking to refine their recruitment strategy, understanding these trends can help in making informed hiring decisions and ensuring the right talent is sourced effectively.

Regional Variations

Regional analysis uncovers significant variations:

- Birmingham: Job vacancies have increased by 15% over the past month, while active candidates have risen by 10%, suggesting a growing market with balanced demand and supply.

- Coventry & Warwickshire: Vacancies have decreased by 5%, whereas active candidates have surged by 20%, indicating a potential oversupply of candidates.

- Leicestershire: Both vacancies and active candidates have remained relatively stable, with less than a 2% change, pointing to a steady market.

Trends Over Time

Examining the data month-by-month:

- December 2024: Job vacancies increased by 10%, while active candidates grew by 5%.

- January 2025: Vacancies remained steady, but active candidates declined by 8%.

- February 2025: Vacancies rose by 5%, with a corresponding 12% increase in active candidates.

This suggests a fluctuating candidate market, potentially influenced by seasonal factors or broader economic conditions.

Market Trends and Insights

Several external factors have influenced recruitment trends in the property industry:

- Economic Indicators: The UK economy showed optimistic signs in early 2024, with GDP growth of 0.7% in Q1 and 0.5% in Q2. This economic growth may have contributed to increased hiring in the property sector.

- Technological Advancements: The integration of artificial intelligence (AI) in recruitment processes has become more prevalent. While 74% of recruitment agencies plan to implement AI, 26% do not, indicating a divide in adoption that could impact efficiency and candidate experience.

- Housing Market Dynamics: The UK property market has experienced regional variations, with some areas seeing increased demand and others facing stagnation. These dynamics directly affect the demand for property professionals across different regions.

Implications for Stakeholders

Employers: To address the shortage of experienced candidates, consider investing in training programs to upskill existing staff.

Additionally, aligning job offerings with the available candidate pool, particularly in administrative roles, can enhance recruitment efficiency.

Job Seekers: Candidates should be aware of regional demand variations. For instance, those in Coventry & Warwickshire may face increased competition, whereas opportunities in Birmingham are expanding.

Policy Makers: Understanding these recruitment trends is crucial for developing policies that support workforce development in the property sector, ensuring that supply meets demand across various roles and regions.

👉

Contact Us Today!

- 📞 Call: 0116 232 5181

- 📧 Email: contact@windmill9.uk

- 💻 Website: www.windmill9.uk

- Visit The Windmill9 LinkedIn Page