UK Property Market & Hiring Update – July 2025

Understanding the latest hiring trends in the UK property sector

Market Trends – Past 30 Days

The UK property market remains mixed. While the Midlands and North have seen stronger performance, southern regions are facing headwinds.

According to Rightmove’s House Price Index (June 2025):

- Average asking prices dropped by 0.3% month-on-month, now at £378,240

- Annual growth sits at 0.8%

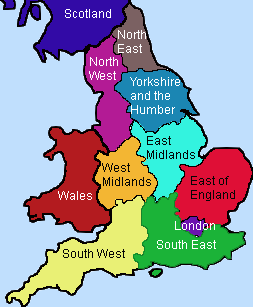

Regional snapshot:

- West Midlands & North West: +2–3% annual price growth (affordability driving demand)

- South East & South West: -1% to -1.6% due to rising supply and stamp duty impacts

Buyer demand remains solid in family-focused areas, especially near good schools. But affordability pressures and elevated mortgage rates (5-year fixed at ~4.61%) continue to cool interest in higher-value markets like London.

Lettings Market Update

Annual rental growth has slowed to 2.8%, down from 6.4% in 2024 (Zoopla, June 2025). This indicates slight market stabilisation, though demand continues to far exceed supply.

Key pressures:

- Stock levels are still 38% below the 5-year average

- Demand is intense: 11 enquiries per property on average (Rightmove, 2024)

- Most affected: 2–3 bed homes in urban centres like London and Manchester

Buyer, Seller & Landlord Activity

- Sales: Agreed sales are up 6% year-on-year – the best since March 2022.

Vendors pricing competitively are 22% more likely to sell quickly (Rightmove).

- Buyers: First-time buyer interest has increased 13%, thanks to expected base rate cuts from 4.75% (Nov 2024) to a projected 3.75% by year-end.

- Landlords: Market confidence is split. While 23% are looking to exit (Propertymark), professional landlords are expanding in high-yield regions like Manchester (6.5–12%) and Scotland.

Policy Update

No new housing policies were announced in June, but upcoming changes are creating uncertainty:

- The Renters’ Rights Bill (abolishing Section 21 evictions) is expected to pass in 2025.

- Tax reforms from the Autumn 2024 Budget (CGT and second-home stamp duty increases) continue to shape investment strategies.

- Further tax speculation remains, potentially influencing landlord behaviour through 2025.

Recruitment & Hiring Trends

Demand for Talent

Recruitment activity remains steady, especially in:

- Lettings Negotiators – due to high enquiry volumes

- Sales Valuers – to support growing listings

Agencies want people who can handle fast-paced urban markets, particularly in lettings.

Skill Shortages

There’s a notable shortfall in:

- Mid-to-senior valuers with strong client handling experience

- Branch and area managers, where market knowledge and leadership are essential

These roles are hard to fill due to broader labour shortages and increased demand for expertise navigating affordability and legislation changes.

Regional Hiring Variations

- South East & Midlands: Ongoing demand in lettings and property management

- South West & Home Counties: Selective hiring focused on high-quality applicants

- Northern Cities (Manchester, Leeds): Modest increase in junior and trainee roles, signalling future talent investment

Salaries

- Base pay remains stable

- In competitive areas like London or prime postcodes, firms are offering signing bonuses or guaranteed commission

- Urban lettings roles (e.g., Manchester) are commanding above-average packages to reflect pressure and opportunity

Market Outlook – Next 4 Weeks

- Sales: Listing volumes will likely edge higher as sellers look to move pre-autumn. Stock is now 11% higher than June 2024 (Rightmove).

- Lettings: High tenant demand will keep pressure on lettings teams, especially in cities.

- Hiring: With talent still scarce, agencies must act fast to secure skilled candidates across sales, lettings, and management.

Final Thought

Despite some market headwinds, the UK property sector remains active. Agencies that act decisively — in both hiring and pricing — are reaping the rewards.

🔹 Need Help Hiring?

At Windmill9 Consulting, we specialise in residential property recruitment. From experienced valuers to lettings talent, we help agencies secure the right people, fast. With deep market insight and a trusted reputation, we’re here to support your growth.

👉

Contact Us Today!

- 📞 Call: 0116 232 5181

- 📧 Email: contact@windmill9.uk

- 💻 Website: www.windmill9.uk

- Visit The Windmill9 LinkedIn Page