UK Property Market & Hiring Insights – October 2025

Understanding the latest hiring trends in the UK property sector

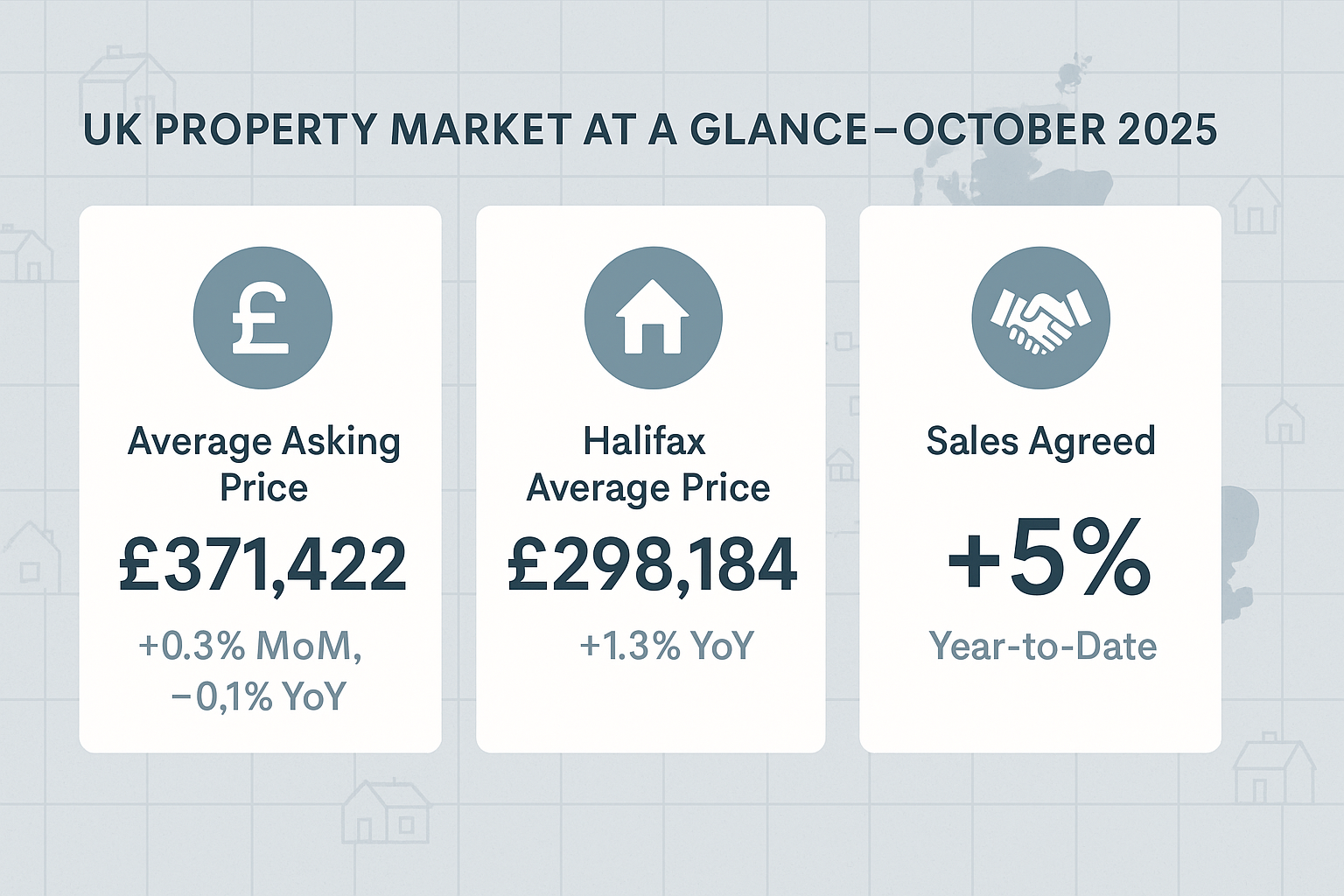

Prices And Headline Momentum

- Asking prices: Rightmove reports an average asking price of £371,422 in October, +0.3% month on month and -0.1% year on year. Sales agreed year to date are +5% versus 2024. London is -1.4% annually, while northern regions and the devolved nations are modestly positive.

- Achieved prices: Halifax shows the average price at £298,184 in September, -0.3% month on month and +1.3% year on year. The picture is broadly stable.

What it means: Pricing is effectively flat, with small monthly moves and a functioning pipeline where vendors are realistic.

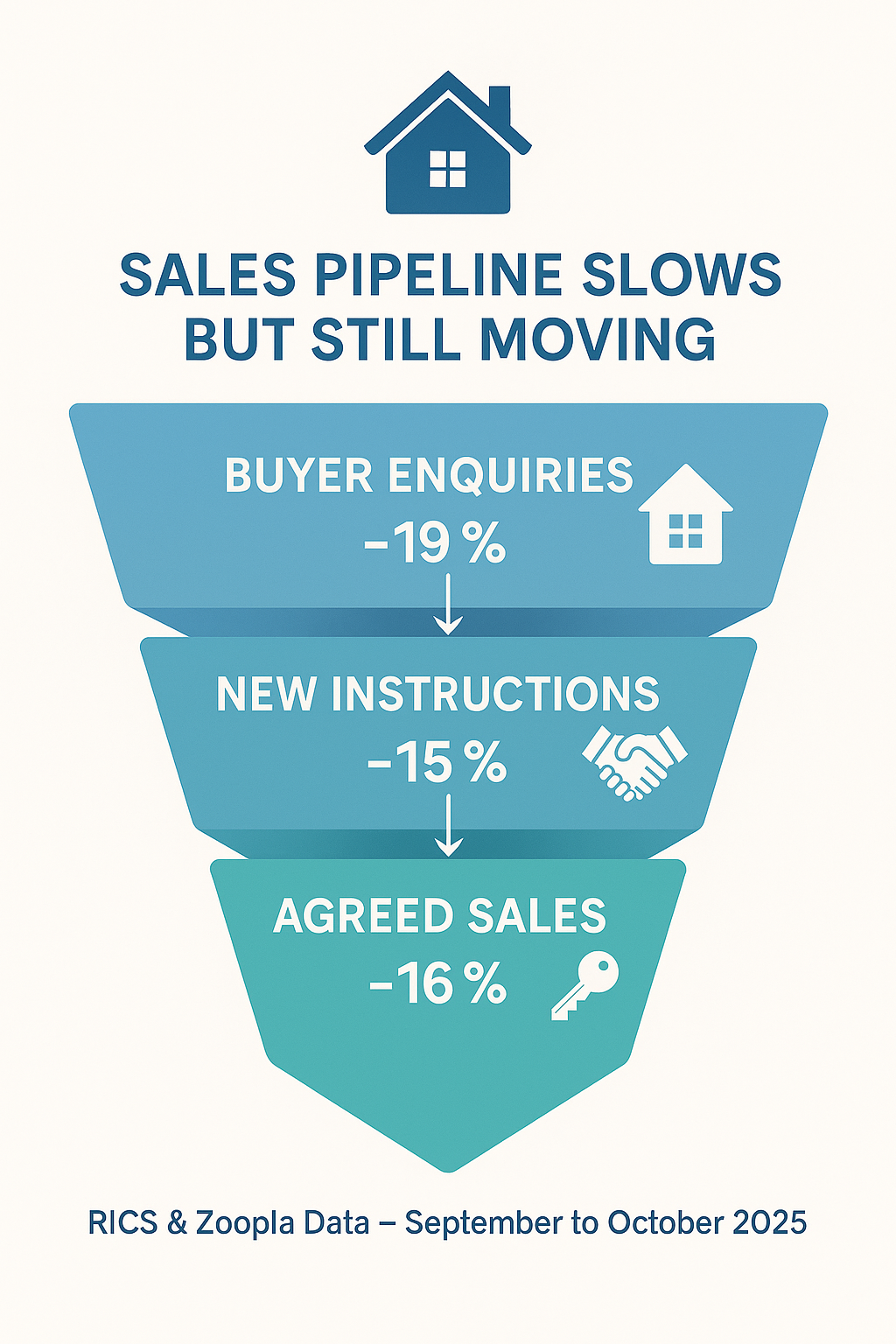

Activity And Sentiment

- Demand and sales flow: RICS shows new buyer enquiries -19% and agreed sales -16% on a net balance basis in September. This is the third consecutive month of weaker demand.

- Zoopla market pulse: Buyer demand is -8% year on year and new sales agreed -3%, with the seasonal slowdown starting earlier than usual. Higher value markets are most affected.

- Mortgages: The Bank Rate is 4%. Average fixed rates eased slightly over the week to 30 Oct: 75% LTV two year at 4.28%, five year at 4.35%; 60% LTV two year at 3.90%, five year at 4.07%

What it means: Buyers are more rate and policy sensitive. Decision cycles are stretching, especially above £500,000, but sensibly priced stock still converts.

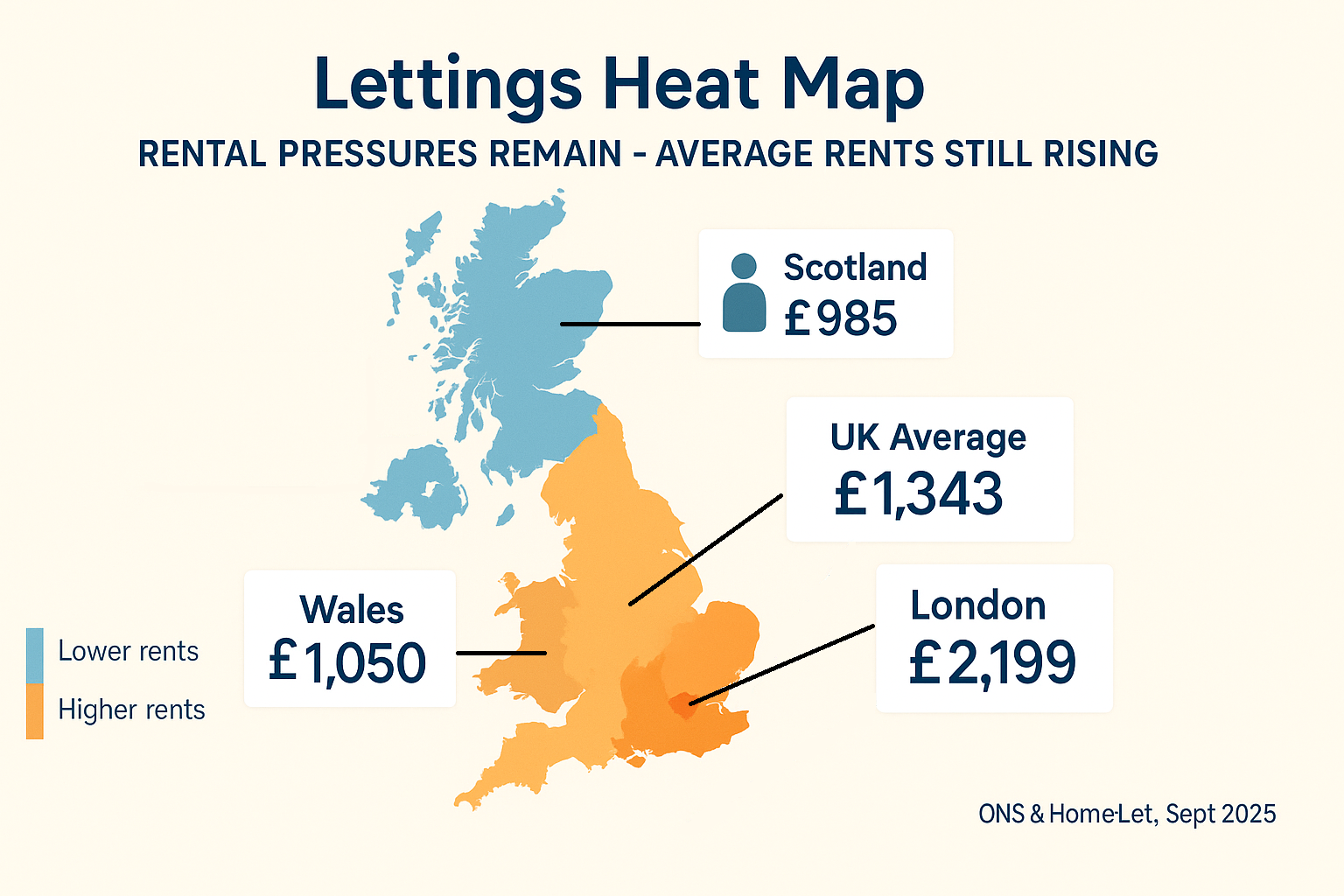

Lettings Market

- Rents: ONS shows private rent inflation easing but still elevated. Annual rent growth was +5.7% in the 12 months to August.

- New-let benchmarks: HomeLet reports the UK average at £1,343 in September, +1.1% month on month. London is £2,199 and near flat year on year.

- Stock and sentiment: Many areas remain supply constrained, although pressure has eased from last year’s peak. Rents are still expected to rise over the next three to twelve months.

What it means: Tenant competition remains firm where stock is tight. Operational pressure points are compliance, renewals, arrears control and move-ins.

Policy Changes In The Past Month

Renters’ Rights Act 2025 became law on 27 October. The Act secures Royal Assent and introduces major reforms across the private rented sector. Commencement will be phased by secondary legislation, with early changes signposted for late December. Agencies should prepare for updated tenancy processes, enforcement and documentation

Hiring And Pay Trends In Estate And Lettings Agencies

Demand by function this month

- Lettings: Highest demand for Property Managers, Renewals and Compliance Officers, Move-in Coordinators and solid demand for Lettings Negotiators, driven by compliance change and landlord churn.

- Sales: Demand for Sales Negotiators and Sales Progressors is steady but more selective, reflecting softer enquiries and a focus on conversion and fall-through risk.

- Leadership: Branch and Area Manager hiring is cautious where stock and fee pipelines are opaque.

Skills in short supply

- Legislation and compliance literacy across lettings, tied to the new Act.

- Sales progression and chain management, as buyers take longer to commit and survey fall-through risk rises.

- Customer remediation and arrears control in property management given affordability pressures.

Regional notes

- London and South East: More selective on senior sales hires and top-end stock. Lettings headcount remains essential.

- Central & Northern: More balanced sentiment with modest price gains and more affordable entry points, supporting negotiator and property management hires.

Pay snapshot

Marketwide data shows subdued starting salary growth in recent months as employers protect budgets, while the best compliance-ready PMs and seasoned sales progressors still command a premium. Mortgage costs have eased slightly, helping deals without materially lifting basic salaries.

Practical Actions For Agency Leaders Now

- Sales: Guard pipelines with stronger progression and buyer financial readiness checks. Use realistic pricing to keep chains intact.

- Lettings: Audit compliance and renewals workflows ahead of phased implementation of the Renters’ Rights Act. Schedule team training and update documents.

- Hiring: Prioritise hard-to-hire skill sets first. Where you spot the right Property Manager or Progressor, move decisively rather than chase headline salary inflation.

4-Week Outlook To Late November

- Sales: Expect a cautious market until after the Autumn Budget, with below-normal seasonal activity and modest pricing drift in weaker micro-markets. Realistic vendor pricing will help.

- Mortgages: Consensus is for Bank Rate to hold at 4% on 6 November. Retail fixed rates likely to move within a narrow range week to week.

- Lettings: Tenant demand steady. Rental growth slower than 2023 but still positive where stock is tight. Begin operational preparations for the new Act as guidance lands.

If you want compliance-ready Property Managers, detail-minded Renewals Officers, or Sales Progressors who keep deals moving, we can help. Windmill9 Consulting specialises in property recruitment across sales and lettings, with deep market insight and a live candidate network.

Sources: Rightmove House Price Index Oct 2025. Halifax HPI Sep 2025. Zoopla HPI Oct 2025. RICS UK Residential Market Survey Sep 2025. ONS Private rent and house prices Sept 2025. Bank of England Bank Rate database and meeting schedule. Rightmove mortgage rate tracker 30 Oct 2025. HomeLet Rental Index Sept 2025. Propertymark guidance on initial commencement dates under the Renters’ Rights Act

👉

Contact Us Today!

- 📞 Call: 0116 232 5181

- 📧 Email: contact@windmill9.uk

- 💻 Website: www.windmill9.uk

- Visit The Windmill9 LinkedIn Page